Welcome to our guide on the top payroll systems for small businesses! Managing payroll can be a time-consuming task for small business owners, but with the right software, it can be made much easier. Whether you are looking to streamline your payroll process, ensure compliance with tax regulations, or simply save time, there are many payroll systems available to help. In this article, we will explore some of the best options on the market for small businesses, so you can find the perfect solution for your needs.

Affordable and User-Friendly Payroll Systems

When it comes to managing payroll for a small business, finding an affordable and user-friendly system is essential. Luckily, there are several options available that cater to the needs of small businesses without breaking the bank.

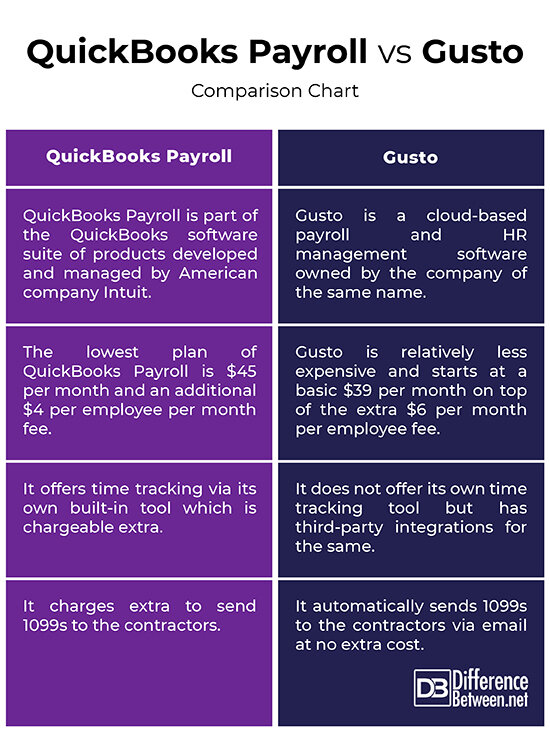

One popular choice for small businesses is Gusto. Gusto offers a range of features at an affordable price point, making it ideal for budget-conscious companies. With Gusto, you can easily process payroll, manage taxes, and even set up employee benefits. The system is designed to be user-friendly, with an intuitive interface that allows you to navigate the platform with ease. Plus, Gusto offers excellent customer support to help you with any questions or concerns that may arise.

Another option for small businesses is QuickBooks Payroll. QuickBooks is a well-known name in the world of accounting software, and their payroll system is no exception. With QuickBooks Payroll, you can easily calculate and process payroll for your employees, as well as manage taxes and deductions. The system is designed to be user-friendly, with step-by-step guides to help you through the process. Plus, QuickBooks integrates seamlessly with other accounting software, making it easy to keep all of your financial information in one place.

For small businesses looking for a more hands-on approach to payroll, ADP is a popular choice. ADP offers a range of payroll solutions for businesses of all sizes, with options to suit every budget. With ADP, you can process payroll, manage taxes, and even handle benefits administration. The system is designed to be user-friendly, with a simple interface that makes it easy to navigate. Plus, ADP offers excellent customer support, so you can get help whenever you need it.

Finally, for small businesses that want a payroll system that is both affordable and easy to use, Paychex is a great option. Paychex offers a range of payroll solutions for small businesses, with packages that cater to businesses of all sizes. With Paychex, you can easily process payroll, manage taxes, and even set up employee benefits. The system is designed to be user-friendly, with an intuitive interface that makes it easy to navigate. Plus, Paychex offers excellent customer support, so you can get help whenever you need it.

Overall, finding an affordable and user-friendly payroll system for your small business is crucial. By choosing a system that fits your budget and is easy to use, you can streamline your payroll processes and save time and money in the long run.

Cloud-Based Solutions for Small Businesses

Cloud-based payroll systems have become increasingly popular among small businesses due to their convenience, accessibility, and affordability. These systems offer a wide range of features and benefits that cater to the unique needs of small businesses, making payroll management easier and more efficient.

One of the key advantages of cloud-based payroll systems is their accessibility. Small business owners and employees can access the system from anywhere with an internet connection, allowing for greater flexibility and convenience. This is especially important for small businesses with remote employees or multiple locations, as it allows for seamless payroll management across different sites.

Another benefit of cloud-based payroll systems is their scalability. Small businesses can easily scale up or down their payroll needs as their business grows or changes. This flexibility is especially important for small businesses that may experience fluctuations in their workforce size throughout the year.

Cloud-based payroll systems also offer advanced security features to protect sensitive payroll data. Data is encrypted and stored securely in the cloud, reducing the risk of data breaches or loss. Additionally, many cloud-based payroll systems offer regular data backups and updates to ensure the security and integrity of the payroll information.

Furthermore, cloud-based payroll systems are typically more cost-effective for small businesses. These systems are often offered on a subscription basis, with no upfront costs or expensive hardware requirements. This makes them an affordable option for small businesses that may not have the budget for a traditional payroll system.

Lastly, cloud-based payroll systems offer a wide range of features and functionalities to streamline payroll processes. From automated tax calculations to customizable reports, these systems automate repetitive tasks and reduce the likelihood of errors. This saves small business owners time and allows them to focus on other aspects of running their business.

In conclusion, cloud-based payroll systems are an excellent choice for small businesses looking to streamline their payroll processes. With their accessibility, scalability, security features, affordability, and range of functionalities, these systems offer small businesses a convenient and efficient solution for managing payroll. As small businesses continue to adapt to the digital age, cloud-based payroll systems will become an essential tool for success.

Customizable Features to Suit Your Business Needs

When choosing a payroll system for your small business, it is important to look for customizable features that can be tailored to meet your specific needs. This will ensure that the system can adapt to the unique requirements of your business and provide you with the tools you need to manage your payroll effectively.

One important customizable feature to look for in a payroll system is the ability to set up different pay structures for different employees. This is particularly useful if your business employs a mix of full-time, part-time, and contract workers, each of whom may have different pay rates and benefits. A good payroll system will allow you to easily set up and manage these various pay structures, ensuring that each employee is paid accurately and on time.

Another customizable feature to consider is the ability to integrate the payroll system with other software programs that your business uses. For example, you may want to link your payroll system with your accounting software to streamline the process of tracking expenses and revenues. Or, you may want to integrate your payroll system with your timekeeping software to automate the process of recording employee hours worked. By choosing a payroll system that offers this level of customization, you can save time and reduce the risk of errors that can occur when transferring data between different systems.

Additionally, look for a payroll system that allows you to customize the types of reports and analytics that are available to you. Being able to generate custom reports based on the specific data points that are most important to your business can help you make more informed decisions and better manage your payroll expenses. Whether you need to track overtime hours, monitor employee attendance, or analyze labor costs by department, having the ability to customize your reporting options can be invaluable.

Lastly, consider the level of customization that is available in terms of user permissions and access controls. Depending on the size and structure of your business, you may want to restrict certain employees from accessing sensitive payroll information or limit their ability to make changes to the system. A payroll system that allows you to customize user permissions can help you ensure that only authorized personnel have access to sensitive data, reducing the risk of security breaches or unauthorized changes to your payroll records.

Integration with Accounting Software for Seamless Operations

One of the key features to look for in a payroll system for small businesses is its integration with accounting software. This integration ensures seamless operations and eliminates the need for manual data entry, saving time and reducing the risk of errors. By integrating payroll and accounting software, businesses can easily track and manage their finances in one place, allowing for better financial reporting and analysis.

When choosing a payroll system, look for one that integrates with popular accounting software programs such as QuickBooks, Xero, or FreshBooks. These integrations allow for automatic syncing of payroll data with the accounting software, streamlining the process and ensuring accurate financial records. Additionally, some payroll systems offer custom integration options for businesses using less common accounting software, providing flexibility and customization.

Integration with accounting software also allows for better compliance with tax regulations. By syncing payroll data with accounting software, businesses can easily generate tax reports and filings, ensuring timely and accurate compliance with government regulations. This integration simplifies the tax reporting process and reduces the risk of penalties for non-compliance.

Furthermore, integration between payroll and accounting software enables better financial analysis and planning. Businesses can track their payroll expenses alongside other financial data, allowing for more informed decision-making and budgeting. This holistic view of the business’s finances can help small businesses identify trends, analyze costs, and make strategic plans for growth.

In conclusion, integration with accounting software is a crucial feature to consider when choosing a payroll system for a small business. By streamlining operations, ensuring compliance with tax regulations, and enabling better financial analysis, this integration can help small businesses save time and money while improving overall financial management.

Scalable Options to Grow with Your Business

When looking for a payroll system for your small business, it’s important to consider options that can grow with you as your business expands. Scalability is key in ensuring that you won’t outgrow your payroll solution anytime soon. Here are some scalable options to consider:

1. Cloud-Based Systems: Cloud-based payroll systems are a great choice for small businesses looking to scale up. These systems offer the flexibility to add more users, features, and functionalities as your business grows. They also allow for easy access from anywhere, so you can manage your payroll on the go.

2. Integration with HR Software: Look for a payroll system that integrates seamlessly with other HR software such as time and attendance tracking, benefits administration, and employee onboarding. This will ensure smooth data flow between different systems and eliminate the need for manual data entry as your business expands.

3. Customizable Features: Choose a payroll system that offers customizable features to suit your growing business needs. Whether it’s setting up complex pay structures, automating tax calculations, or generating custom reports, make sure the system can adapt to your changing requirements.

4. Scalable Pricing Plans: Ensure that the payroll system you choose offers scalable pricing plans that can accommodate your budget as your business grows. Look for options that offer different tiers based on the number of employees or features included, so you can easily upgrade when needed.

5. Multi-Country Support: If your small business has plans to expand internationally, it’s crucial to choose a payroll system that offers multi-country support. Look for a system that can handle payroll calculations, tax compliance, and reporting for different countries, so you can easily manage your global workforce.

By considering these scalable options when choosing a payroll system for your small business, you can ensure that your system can grow with you as your business expands. With the right solution in place, you can focus on growing your business without worrying about outgrowing your payroll system.

Originally posted 2025-09-23 19:50:39.